9 Easy Facts About Amur Capital Management Corporation Shown

9 Easy Facts About Amur Capital Management Corporation Shown

Blog Article

The 10-Second Trick For Amur Capital Management Corporation

Table of ContentsGetting My Amur Capital Management Corporation To WorkAmur Capital Management Corporation - TruthsThe 25-Second Trick For Amur Capital Management CorporationOur Amur Capital Management Corporation StatementsThe Buzz on Amur Capital Management CorporationExamine This Report about Amur Capital Management Corporation

This makes real estate a successful long-term financial investment. Real estate investing is not the only method to spend.

The Best Guide To Amur Capital Management Corporation

Smart investors may be awarded in the kind of appreciation and dividends. Since 1945, the average huge supply has actually returned close to 10 percent a year. Supplies truly can act as a lasting cost savings vehicle. That said, stocks can equally as quickly drop. They are by no indicates a safe bet.

However, it is simply that: playing a video game. The stock market is as much out of your control as anything can be. If you buy supplies, you will certainly be at the grace of a reasonably unpredictable market. That stated, property is the polar contrary pertaining to specific aspects. Internet incomes in realty are reflective of your own activities.

Any cash gained or shed is a direct outcome of what you do. Stocks and bonds, while frequently abided together, are fundamentally various from each other. Unlike stocks, bonds are not representative of a risk in a company. Because of this, the return on a bond is taken care of and does not have the opportunity to value.

Not known Details About Amur Capital Management Corporation

The real advantage realty holds over bonds is the time structure for holding the investments and the price of return during that time. Bonds pay a fixed interest rate over the life of the investment, hence acquiring power with that said passion goes down with rising cost of living gradually (exempt market dealer). Rental residential property, on the other hand, can generate greater rental fees in periods of higher rising cost of living

It is as basic as that. There will always be a need for the rare-earth element, as "Fifty percent of the world's populace relies on gold," according to Chris Hyzy, chief investment police officer at united state Depend on, the personal riches management arm of Financial institution of America in New York City. According to the World Gold Council, demand softened last year.

Amur Capital Management Corporation Fundamentals Explained

Recognized as a relatively risk-free product, gold has actually developed itself as a vehicle to enhance investment returns. Some don't even think about gold to be a financial investment at all, instead a bush versus rising cost of living.

Naturally, as safe as gold may be thought about, it still stops working to continue to be as eye-catching as actual estate. Below are a few reasons investors choose realty over gold: Unlike property, there is no funding and, consequently, no room to leverage for growth. Unlike real estate, gold proposes no tax advantages.

The 10-Minute Rule for Amur Capital Management Corporation

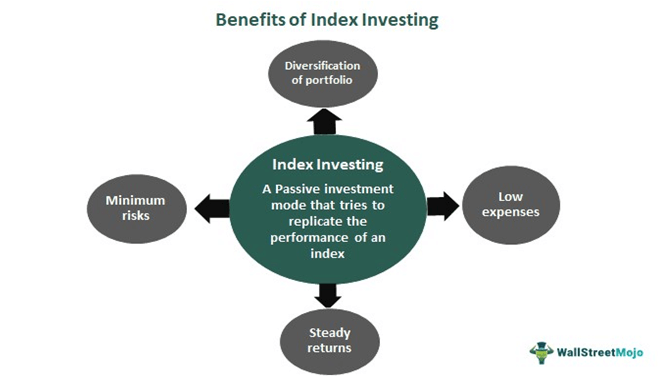

When the CD matures, you can accumulate the initial financial investment, in addition to some rate of interest. Deposit slips do dislike, and they've had a historical ordinary return of 2.84 percent in the last eleven years. Realty, on the various other hand, can appreciate. As their names suggest, common funds consist of finances that have actually been pooled with each other (mortgage investment).

It is among the most convenient ways to branch out any kind of portfolio. A shared fund's efficiency is always measured in regards to complete return, or the amount of the adjustment in a fund's web property worth (NAV), its dividends, and its funding gains circulations over an offered period of time. However, much like supplies, you have little control over the efficiency of your properties. https://amur-capital-management-corporation.jimdosite.com/.

Actually, placing money into a common fund is essentially handing one's investment choices over to a specialist money manager. While you can decide on your financial investments, you have little say over exactly how they do. The 3 most usual means to purchase genuine estate are as follows: Acquire And Hold Rehabilitation Wholesale With the why not try these out most awful component of the recession behind us, markets have undergone historic appreciation prices in the last three years.

Facts About Amur Capital Management Corporation Revealed

Acquiring reduced doesn't imply what it used to, and capitalists have actually acknowledged that the landscape is changing. The spreads that wholesalers and rehabbers have actually ended up being accustomed to are beginning to raise up memories of 2006 when values were historically high (investing for beginners in canada). Obviously, there are still plenty of possibilities to be had in the globe of flipping realty, yet a new leave approach has emerged as king: rental residential or commercial properties

Or else referred to as buy and hold residential properties, these homes feed off today's gratitude prices and profit from the truth that homes are more pricey than they were simply a few brief years back. The concept of a buy and hold leave technique is simple: Financiers will aim to enhance their profits by leasing the home out and accumulating month-to-month capital or simply holding the home till it can be cost a later day for an earnings, of course.

Report this page